Investing with Foresters

Giving you the choice to invest your way. We have specially selected the professionals at Schroders to look after your money and make investment decisions for you, so all you have to do is choose your fund(s).

Giving you the choice to invest your way. We have specially selected the professionals at Schroders to look after your money and make investment decisions for you, so all you have to do is choose your fund(s).

Whether you're new to investing or have been investing for a while, choosing how to invest your money is an important decision. At Foresters, we want to give you the flexibility to choose how your savings are invested with a range of products, for different savings goals. Along with the experts at Schroders, we have a choice of funds to help make investing in your future easy.

A global multi-asset fund designed for Foresters’ customers.

A sustainable fund for a greener future.

Invest in a Shariah compliant fund.

Keep up to date with how our funds are performing with our Investment Bulletins.

Foresters Stakeholder (Schroders) Managed Fund

Q4 Bulletin 2025

Q3 Bulletin 2025

Q2 Bulletin 2025

Foresters Stakeholder (Schroders) Sustainable Future Managed Fund

Q4 Bulletin 2025

Q3 Bulletin 2025

Q2 Bulletin 2025

Foresters (Schroders) Managed Islamic Global Fund

Q4 Bulletin 2025

Q3 Bulletin 2025

Q2 Bulletin 2025

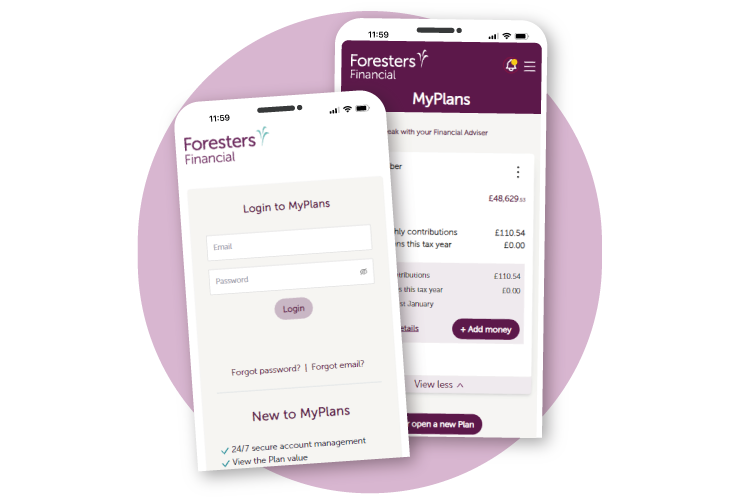

You can view the performance of your fund if you have an ISA, CTF, Junior ISA or Savings & Investment Plan with us at any time on MyPlans.

When you have decided to save towards your, or your child's future it is important to choose the right product and understand the fund(s) available to you.

|

|

Foresters Stakeholder (Schroders) Managed Fund |

Foresters Stakeholder Sustainable Future Managed Fund |

Foresters (Schroders) Managed Islamic Global Fund |

| Professionally Managed | Yes | Yes | Yes |

| Products available | ISA, Junior ISA, Savings & Investment Plan, Child Trust Funds, Personal Pension Plan | ISA, Junior ISA, Savings & Investment Plan and Child Trust Funds | ISA, Junior ISA, Savings & Investment Plan |

| Ability to fund switch | ✓ Yes, if you have an ISA, Junior ISA, Savings & Investment Plan or a Child Trust Fund you can switch into the Foresters Stakeholder (Schroders) Sustainable Future Managed Fund | ✓ Yes, if you have an ISA, Junior ISA, Savings & Investment Plan or a Child Trust Fund you can switch into the Foresters Stakeholder (Schroders) Managed Fund | No, if you would like to invest in another fund with us you would need to make a transfer |

| Risk Level | Medium-low risk profile | Medium-low risk profile | Medium risk profile |

Charge |

1.5% each year, reducing to 1% after 10 years for JISAs, ISAs, Savings & Investment Plans and Personal Pension Plan* | 1.5% each year, reducing to 1% after 10 years for JISAs, ISAs and Savings & Investment Plans* | 1.5% each year, reducing to 1% after 10 years |

Sustainable investing? |

No | ✓ Yes, the aim of the fund is to invest in a greener future | No |

Shariah compliant? |

No | No | ✓ Yes, the aim of this fund is to invest under Islamic guidance |

| Invests Globally | Yes | Yes | Yes |

*Child Trust Fund annual management charge varies dependent on the investment

Take a look at the products that we offer that allow you to invest in the funds mentioned above.

Want to save towards your future

Take a look at our ISA, Lifetime ISA or Savings & Investment Plan

Want to save towards your child’s future

Take a look at our Junior ISA

Already have a Child Trust Fund and you would like to switch it to us

Take a look at your transfer options

If you are planning for retirement

Take a look at our Personal Pension Plan

Please note at present our Personal Pension Plan invests only in the Foresters Stakeholder (Schroders) Managed Fund.

Let the professionals make the investment decisions for you, so you don’t have to. Schroders is an independent, dedicated asset manager with a strong heritage and culture based on over 200 years’ experience of investment markets.

At Foresters we look after a range of Child Trust Funds with different investments types, including Stakeholder, Non-Stakeholder and Shariah Child Trust Funds. Understand how the Child Trust Fund is invested with us.

View how the Plan is performing

See the Plan value, fund performance, our other products and more at any time.

Make contributions in just a few clicks

It's easy to set up or amend contributions and gift to a child’s Plan at your convenience.

You can do it all yourself

MyPlans makes it easier to manage your Plan online, allowing you to make updates as you need to.

Watch our quick 3 minute video on how to create your MyPlans account.

Read our articles on savings products and investing, so you can feel in control of your money and finances.