Protection Options

Helping you prepare for the future from as little as £10 a month with insurance options that suit your needs when protecting yourself and your loved ones.

Helping you prepare for the future from as little as £10 a month with insurance options that suit your needs when protecting yourself and your loved ones.

There’s no way of knowing what's ahead, but you can take steps to be financially protected. We want to help you ensure that your family are financially covered, and our choice of Personal Insurance and Mortgage Protection can offer you just that.

Personal Insurance is a protection Plan that offers you cover against death, critical illness, terminal illness and permanent disability.

Mortgage Protection is a protection Plan to repay an outstanding mortgage or loan when faced with death, critical illness, terminal illness and permanent disability.

Providing you cover in the event of death or a terminal illness. Available for Personal Insurance and Mortgage Protection.

Learn more✔ Premature death and terminal illnesses cover

✔ Cover provided for minimum of 5 years up to age 85

✔ Optional extra of Waiver Of Premiums

✔ Personal Financial Advice face-to-face or video appointments

✔ Your claim payment is tax-free and will be paid by lump sum, or with the option of annual income for Personal Insurance

✔ Additional options for Mortgage Protection - single or joint cover and level or decreasing term

✔ Guaranteed option to increase cover as your circumstances change

Provides cover for total permanent disability and critical illnesses. Available for Personal Insurance and Mortgage Protection.

Learn more✔ Critical illness and total permanent disability cover

✔ Cover provided for minimum of 5 years up to age 65

✔ Optional extra of Waiver Of Premiums

✔ Personal Financial Advice face-to-face or video appointments

✔ Your claim payment is tax-free and will be paid by lump sum, or with the option of annual income for Personal Insurance

✔ Additional options for Mortgage Protection - single or joint cover and level or decreasing term

✔ Guaranteed option to increase cover as your circumstances change

Provides cover for either death, critical illness and permanent disability. Available for Personal Insurance and Mortgage Protection.

Learn more✔ Death, terminal illnesses, critical illness and total permanent disability cover

✔ Cover provided for minimum of 5 years up to age 65

✔ Optional extra of Waiver Of Premiums

✔ Personal Financial Advice face-to-face or video appointments

✔ Your claim payment is tax-free and will be paid by lump sum or with the option of annual income for Personal Insurance

✔ Additional options for Mortgage Protection - single or joint cover and level or decreasing term

✔ Guaranteed option to increase cover as your circumstances change

If you are not in a high-risk occupation you can choose to have Waiver Of Premium cover when you apply for your Plan. This pays your premiums if you are unable to work due to incapacity. So, you can continue to cover yourself whilst you recover.

If you choose this cover, we’ll pay your premiums after six months of incapacity. We'll continue to pay them until the first of these events; you recover and are no longer incapacitated, your 65th birthday, your cover ends or should you die.

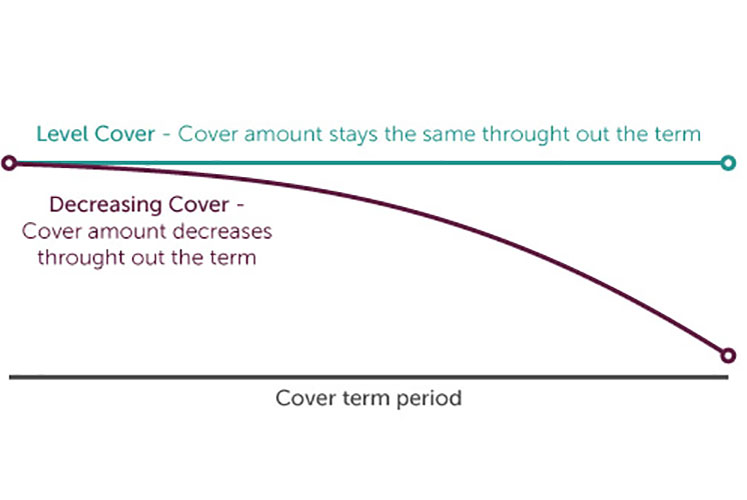

Depending on how you are repaying your mortgage you can choose to receive your cover. This can be on a level basis (same amount throughout) or decreasing basis (pay less as the mortgage reduces).

If you choose level cover, the amount of your benefit will remain the same throughout the term of your Plan. You should consider this option if you have an interest only mortgage.

If you choose decreasing cover, the amount of your benefit will reduce each year during the term of your Plan. You should consider this option if you are repaying your mortgage by regular instalment over the loan period.

You can't prepare yourself for the emotional challenges of a life limiting illness, and there's no manual on how to deal with grief. Whilst we can't change these events, our protection products offer a Peace of Mind service.

This specialist advice service is staffed by experienced nurses who are on hand to offer expert help and guidance. Should the worst happen, your partner and children will have access to bereavement counselling with up to six sessions at no extra cost. .

You can protect your family with a free, personalized online document preparation service. From the comfort of your own home, you can create a Will, Power of Attorney, and healthcare directives.

As a member, you have access to this benefit and more. This includes helping your local community through volunteer grants, taking part in or organising Family Fun events. There's also the opportunity for you or your children to apply for scholarships.

Please note: The Peace of Mind service and Foresters member benefits are not regulated, non-contractual, and are not part of the Protection Plan Terms and Conditions. They may be subject to specific eligibility requirements and can be amended or withdrawn without notice..

Description of member benefits that you may receive assumes you are a Foresters member. Members must be 18 years of age or older and must have an active Foresters Plan and maintain it in good standing. Foresters member benefits are non-contractual, subject to benefit specific eligibility requirements, definitions and limitations and may be changed or cancelled without notice. Member benefits are not regulated by the Prudential Regulation Authority or the Financial Conduct Authority and may change in the future.

Protection Key Features for both Personal Insurance and Mortgage Protection

For further information on our protection options, you can speak to one of our Financial Advisers. They’ll explain how they work, which level of cover may be most suitable for you and provide an insurance quote. Fill out our form to request an appointment with one our Advisers. There is no charge for protection advice.