A more resilient future

Improving our operations and investing with tomorrow in mind

Improving our operations and investing with tomorrow in mind

North America achieved a reduction in emissions, driven by operational improvements such as consolidating office space. In our Toronto office, a key factor was reduced gas usage, achieved by improving boiler efficiency through the building automation system. Milder weather also contributed by reducing the need for heating. Also, various energy-saving measures were implemented, including minimising energy use outside of business hours and upgrading ventilation systems to operate more efficiently.

Despite a growing headcount, our UK-based Bromley office has maintained emissions in line with the prior year by transitioning more of our sales force to hybrid and electric vehicles. Finally, the continued procurement of zero-carbon electricity has supported keeping emissions low.

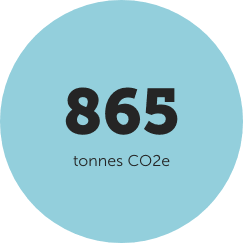

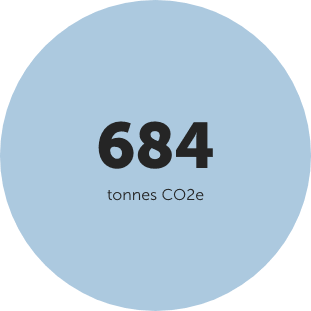

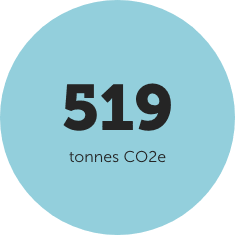

Tonnes of CO2e in our own operations (Scope one and two)

Reduction from 2022 to 2023 9

Reduction from 2023 to 2024 10

Tonnes of CO2e in our own operations (Scope one and two)

Drop in carbon emissions in 2023 vs 2024 in Foresters Canadian headquarters 11

Drop in carbon emissions in 2023 vs 2024 in Foresters UK head office and fleet 12

Circles are not to scale, for illustrative purposes only.

Our investment philosophy at Foresters is built around protecting our members’ financial futures while fulfilling our organisation’s purpose.

While we strive to continually improve returns with our investments, we are also always considering Environmental, Social and Governance (ESG) factors. Part of how we do this is by working closely with asset managers who share our outlook on ESG risks and believe in the importance of including ESG considerations in their processes

of all professional asset managers engaged by Foresters are United Nations Principles for Responsible Investment signatories 13

CAD

Invested in green, social or sustainable bonds14 and the UK Sustainable Future Managed Fund (as of 31 December 2024)

Across Canada and the US, our investments include green, social and sustainable bonds and projects supporting clean energy.

The 2024 target goal of investments into green, social or sustainable bonds with our North American core managers

The 2024 percentage of investments in green, social or sustainable bonds with our North American core managers that Foresters achieved

CAD

The dollar amount invested in green, social or sustainable bonds with our North American core managers after exceeding our original target 15

In 2025 we will target

invested in green, social or sustainable bonds (with our North American core managers).

In 2023, we launched our Foresters Stakeholder Sustainable Future Managed Fund. Professionally managed by Schroders, the fund has adopted a ‘Sustainability Mixed Goals’ label and invests at least 70% in companies and countries working to lower carbon emissions or are already keeping their carbon emissions low.

Over 10% of new UK business is invested in the Sustainable Future Managed Fund in 2024 when the customer has chosen to invest in a Stakeholder Product. 16

9 Calculated internally based on GHG Protocol, consistent with ISSB, TCFD recommendations.

10 2023 comparison figures have been adjusted to reflect that the scope 1 UK gas emissions are natural gas instead of biogas as originally reported. Figure is rounded to the nearest whole number.

11 Calculated internally based on GHG Protocol, consistent with ISSB, TCFD recommendations. Figure is rounded to the nearest whole number.

12 Calculated internally based on GHG Protocol, consistent with ISSB, TCFD recommendations. 2023 comparison figures have been adjusted to reflect that the scope 1 UK gas emissions are natural gas instead of biogas as originally reported. Figure is rounded to the nearest whole number.

13 https://www.unpri.org/signatories

14 Green, social or sustainable bonds held in Foresters asset portfolios have been represented by their respective issuers in public securities filings to be in alignment with green or sustainable principles established by the International Capital Market Association. For more information, please visit https://www.icmagroup.org/sustainable-finance. US$ and £ values have been converted to CAD$ using the spot rate on 31/12/2024.

15 Green, social or sustainable bonds held in Foresters asset portfolios have been represented by their respective issuers in public securities filings to be in alignment with green or sustainable principles established by the International Capital Market Association. For more information, please visit https://www.icmagroup.org/sustainable-finance. US$ values have been converted to CAD$ using the spot rate on 31/12/2024.

16 % of new business when the customer has chosen to invest in a Stakeholder Product. At the start of their journey the customer choses to invest in either a Shariah product or a Stakeholder product.