Why invest with Foresters?

Highly rated

Our customers and members rate us 4.7 out of 5 for our service

Trusted

2.4m customers in the UK, US, and Canada, with £5.6bn UK FUM

Established

Managing family finances and making a positive impact for over 150 years

We go the extra mile

Financial Advisers, expert investment managers, and exclusive benefits

Why Choose Foresters

Est. 1874

Taking care of family finances for over 150 years. With more than 2.4 million customers and members.

Helping is who we are

We are a mutual organisation helping to make a difference. We are driven to share, not shareholder driven.

Putting our customers first

Choice in how you do business with us, from managing your online account to having your Financial Adviser on hand.

Find out more about Foresters Financial 🡢

What IS A

Become more financially savvy and learn all the basics to be in control of your finances.

See what our customers have to say...

❝ Always happy with his explanations of products based on the information I give him. He listens to my needs if circumstances have changed. Very informative ❞

❝My Financial Adviser was extremely friendly and thorough and talked me through anything I was unsure about. I felt comfortable and am looking forward to saving for my daughters future with you! ❞

❝We’re so happy to be part of the Foresters, sound financial advice from friendly advisers. We couldn’t be happier with the whole experience. ❞

Personal Insurance

Personal Insurance is a protection Plan that offers you cover against death, critical illness, terminal illness and permanent disability.

Mortgage Protection

Mortgage Protection is a protection Plan that offers you cover designed to repay a mortgage in the event of death, critical illness, terminal illness and permanent disability.

Individual Savings Account (ISA)

Our ISA has the option of combining a Stocks and Shares ISA and a Lifetime ISA in one Plan. You can start saving for those future milestones from as little as £20 up to £20,000 this tax year.

Savings & Investment Plan

Our Savings & Investment Plan is designed to provide flexible terms, low charges and medium to long-term growth in risk-controlled funds with no savings limit.

Child Trust Fund

Looking after over 1.3 million children's savings Plans, we are here to help you save for your child’s future. You can no longer open a Child Trust Fund, but you can still contribute and transfer to us.

Personal Pension

Whether retirement seems far off or just around the corner, a pension could ensure a more comfortable later-life. If you do not already have a workplace pension our Personal Pension Plan may be a suitable option.

Financial markets have recently experienced volatility due to the sharp rise in global inflation. We have seen large falls in many types of investments, including bonds and equities that your fund may invest in. Our general advice is to keep calm and think about your medium to long-term investment plans. For more information, read our article, investing in volatile market.

Giving you the choice to invest your way

Our professionals make investment decisions for you - making investing for the future easy. With our ISA, Lifetime ISA and Junior ISA you have the option to invest in a choice of funds.

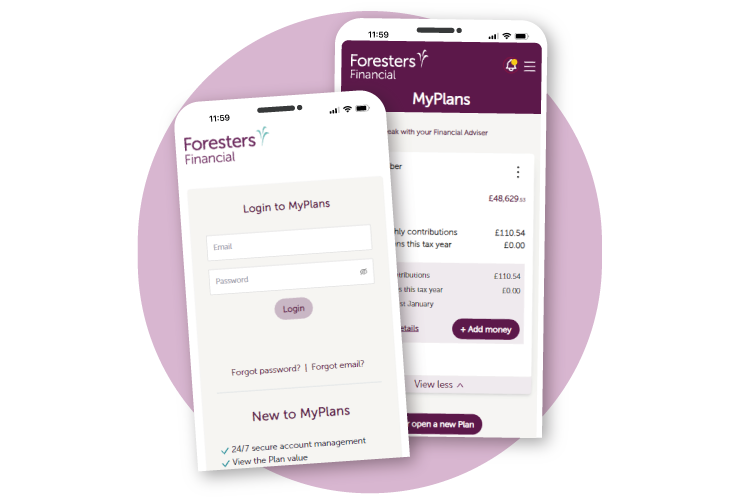

MyPlans

If you have a savings plan with us, you can manage your Plan online with MyPlans. MyPlans allows you to make payments online, view your Plan value, see the fund performance, investment information and contact your Financial Adviser.

To view your Matured CTF ISA, ISA, Savings & Investment Plans, Child Trust Funds or Junior ISAs online all you need is your Plan number, date of birth(s) and postcode to set up your My Plans account.

Watch our videos on how to create and navigate around your MyPlans account.

MyForesters

If you have a Plan with Foresters and are aged 18 or over, you can access your benefits through MyForesters. On MyForesters, you can access LawAssure, apply for grants, check your current grant applications, join community and fun family activities and more.

To register for MyForesters you’ll need:

- Your Plan number

- Your email address on our records