Shariah fund

Invest in a Shariah compliant fund that aligns with your beliefs

Invest in a Shariah compliant fund that aligns with your beliefs

The fund is professionally managed by Schroders and invests in the Schroder Islamic Global Equity Fund. Aiming to grow your investment over the medium to long-term, by investing in a Shariah compliant portfolio of shares from around the world.

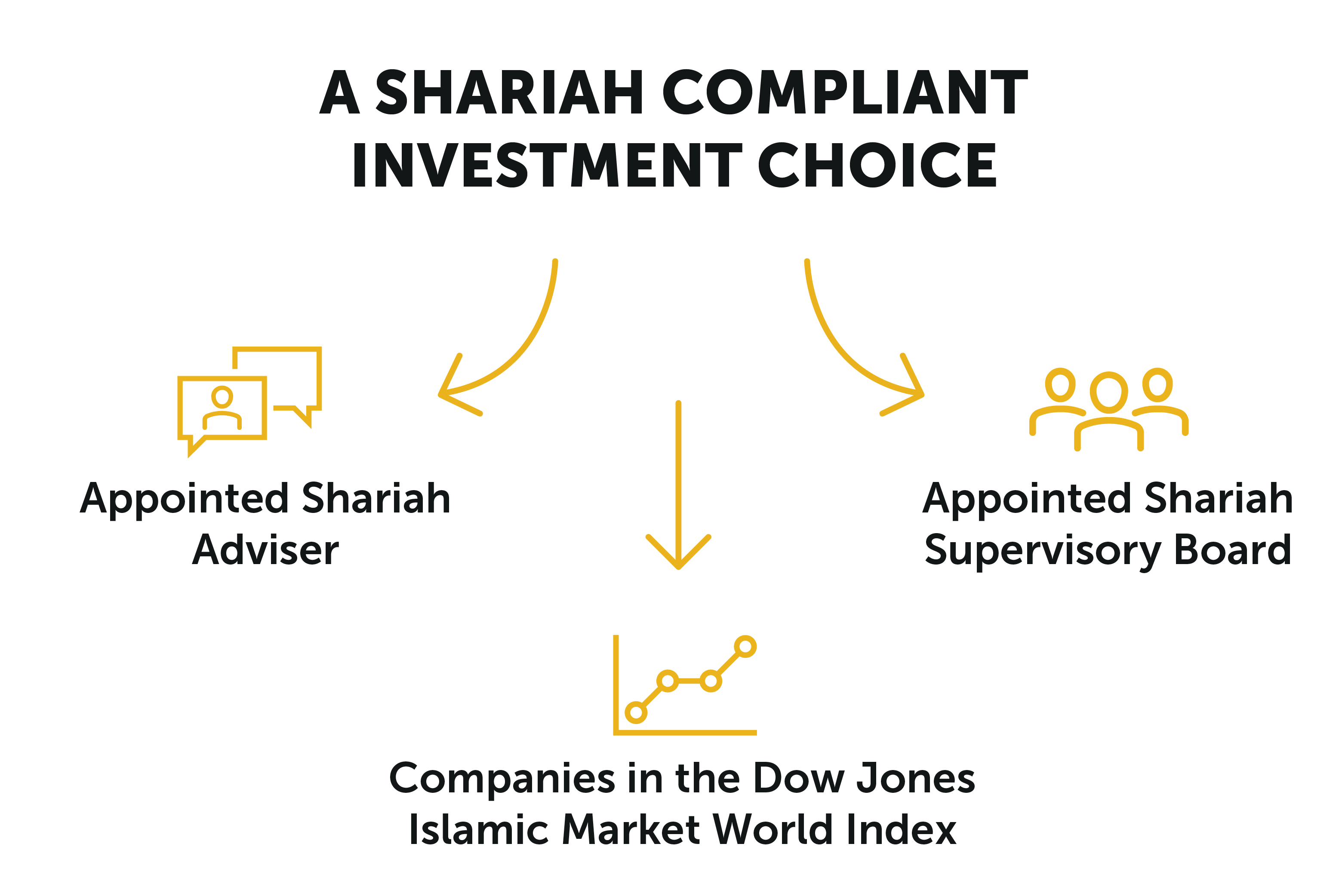

The fund will only invest in companies included in the Dow Jones Islamic Market World (Net Total Return) Index. A Shariah Supervisory Board and Shariah Adviser have been appointed to ensure all investments in the fund meet Shariah Investment Guidelines. Amanie Advisors Ltd have been appointed as the Shariah Advisor.

The Shariah Supervisory Board, made up of Shariah Scholars, is responsible for issuing the launch fatwa in respect of the fund and provide guidance, adhoc views and review the operations and investments of the fund, via the Shariah Advisor. The operations are reviewed regularly and reported quarterly to ensure the continuing compliance of the fund with Shariah Investment Guidelines.

.

The fund may not invest in companies where more than 5% of their total income is made from prohibited activities or industries, such as below...

Entertainment inc. Hotels/gambling

Pork-related products

Non-Islamic financial services

For more information about how the fund is invested read the Important information and Key Information Document for that product.

Also, any company whose financial arrangements are considered unsuitable for Shariah compliance such as unacceptable amounts of debt, cash or interest bearing securities. As the fund is managed in line with Shariah Investment Guidelines, it may perform less well than other funds that do not strictly adhere to these criteria.

What happens to investments which become non-compliant?

It is the intention to observe the Shariah Investment Guidelines at all times but this may not always be possible as there may be occasions when a company becomes non-compliant. The requirement to ‘purify’ prohibited income (and potential investment gains where companies become non-compliant) is likely to result in payments to UK registered charities that have been approved by the Shariah Supervisory Board. These payments could reduce the fund’s performance compared with other funds that do not strictly adhere to the Shariah Investment Guidelines.

Take a look at the products that we offer that allow you to invest in the Shariah fund.

Want to save towards your future

Take a look at our Shariah ISA, Shariah Lifetime ISA or Shariah Savings & Investment Plan

Want to save towards your child’s future

Take a look at our Shariah Junior ISA

If you or your child already have a Child Trust Fund - Shariah with us

When they turn 18 they will have the option to reinvest in a Shariah ISA

If you would like to switch a Child Trust Fund to Foresters

Take a look at the transfer options available

Let the professionals make the investment decisions for you, so you don’t have to. Schroders is an independent, dedicated asset manager with a strong heritage and culture based on over 200 years’ experience of investment markets.

View Plan value and fund performance

Make contributions in just a few clicks

Open new products

Financial guidance

Update your personal details

Access to your documents