Saving with us is a breeze

We offer a range of simple and affordable savings for yours and your child’s future.

We offer a range of simple and affordable savings for yours and your child’s future.

Simple, affordable investing with financial guidance

Our customers rate us 4.7 out of 5 stars

Taking care of family finances for nearly 150 years

Our ISA has the option of combining a Stocks and Shares ISA and a Lifetime ISA in one Plan. You can start saving for those future milestones from as little as £20 up to £20,000 each tax year.

Save for your first home and/or later on in life. With a Government bonus of 25% on your contributions. Meaning you could add an extra £1,000 to your savings each year. Save from as little as £20 up to £4,000 each tax year.

Save for your child's tomorrow today from as little as £10 a month and help give them a head start in adult life. Family and friends can contribute too, making the perfect gift.

Looking after over 1.2 million children's savings Plans, we are here to help you save for your child’s future. You can no longer open a Child Trust Fund, but you can still contribute and transfer to us.

Our Savings & Investment Plan is designed to provide flexible contribution terms, low charges and medium to long-term growth. With no limit on the amount you can save.

Whether retirement seems a long way off or just around the corner, a pension could ensure a more comfortable later-life. If you do not already have a workplace pension our Personal Pension Plan may be a suitable option.

Giving you the choice to invest your way. The professionals make the investment decisions for you – so you don’t have to worry about being a financial expert.

A global, straightforward fund designed for Foresters customers.

Invest for your future in a fund that has a focus on sustainability.

Invest for your future in Shariah compliant fund that aligns with your beliefs.

We look after over 1.4 million savings Plans, with simple and affordable savings options so you can save tax-efficiently.

We help make investing easy and offer professionally managed funds, where the experts at Schroders make investment decisions on your behalf - so you can focus on the things that really matter.

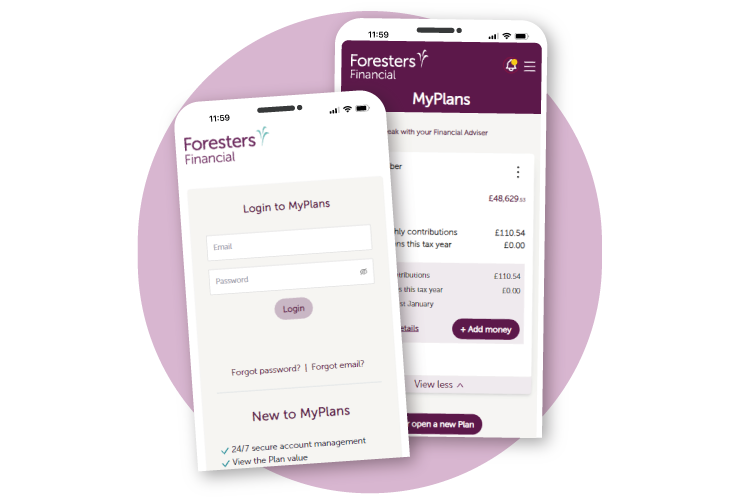

View how the Plan is performing

See the Plan value, fund performance, our other products and more at any time.

Make contributions in just a few clicks

It's easy to set up or amend contributions and gift to a child’s Plan at your convenience.

You can do it all yourself

MyPlans makes it easier to manage your Plan online, allowing you to make updates as you need to.

Are you a customer with a Forester Life With Profit Fund, Communication Workers With-Profit Fund, Deferred Pension Funds and/or a product which was originally held with The Tunbridge Wells Equitable Friendly Society?

Find out what financial solutions work best for you by speaking to one of our Financial Advisers.

We provide personal financial planning either face-to-face or by video appointment. With over 190 Advisers you can be assured of personal attention and a quality service. Our Advisers work solely for Foresters and are paid directly, therefore you will not be charged for any advice given.

Ready to get saving but not sure where to start? Read our articles on savings products and investing, so you can feel in control of your money.