The importance of saving

Watch our savings videoWhen you save a bit, big things follow

At Foresters Financial we are committed to helping you save towards the future. We have put together why saving is important to prepare for some of the costs of key milestones in yours and your family’s future.

With the recent impacts on the economy, there is never a better time to think about more ways to focus on your savings.

We provide financial solutions with a difference to help with yours and your family’s future.

Savings habits in the UK

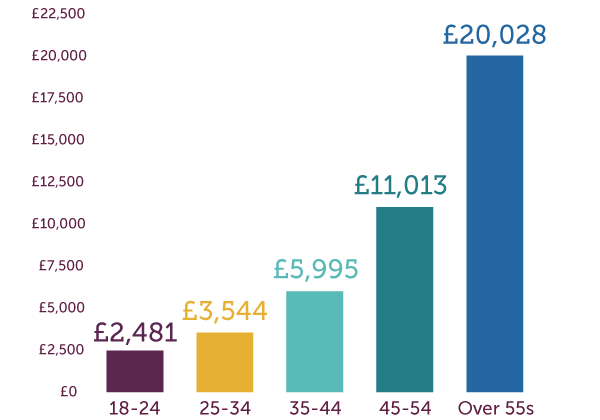

Average savings by age

Individuals in the UK have an average savings pot of £9,633. With 18-24s having the lowest savings of £2,481 and over 55s having the most savings at £20,028.

Although not everyone has this much, experts recommend having three months’ worth of salary as a safety savings pot.

Saving for a car?

Is your child eager for the freedom of driving their own set of wheels to explore different places and visit friends and family? Are you eager for a new family estate car? A car in the UK costs on average £18,139 and there are over five million leased cars on the road, with millions choosing this option to help with financing to get out on the road.

Find out more about becoming a new driver

The average price of a first car is currently £3,562.

![]()

Learning to drive could cost up to £2,166. Costs include getting a provisional licence, lessons, theory and practical tests.

What do you want to save for?

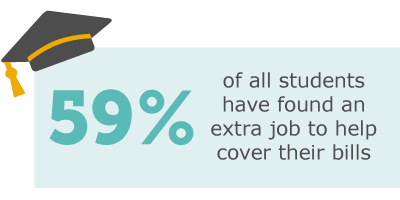

Saving for University?

Attending university is an exciting milestone. From teachers to engineers, vets to doctors, there are many courses to kickstart careers! Whatever your chosen university course, it can come at a hefty price tag. Find out more if you have a child who is soon to be going to university

If you or your child is wanting to study for a three-year course for the 2020/21 academic year, you could be looking at being left with up to £56,868 in university debt (living outside of London) or £65,751 (living in London). This figure includes the tuition fee and maintenance loan for living costs, such as food and accommodation.

Compared to the 2020/21 academic year, students were looking at debts of £45,465 (living outside of London) or £53,727 (living in London). This increase is due to the government plans for maintenance loans to increase by 2.8% for the 2023/2024 academic year.

In 2021/22 over 349,200 individuals started an apprenticeship and although there are no tuition costs, a salary below minimum wage whilst learning on the job means that the cost of living and paying for books to support academic development can have a strain on purse strings dependent on an individual’s circumstance – any savings will help support further education.

Saving for your first home?

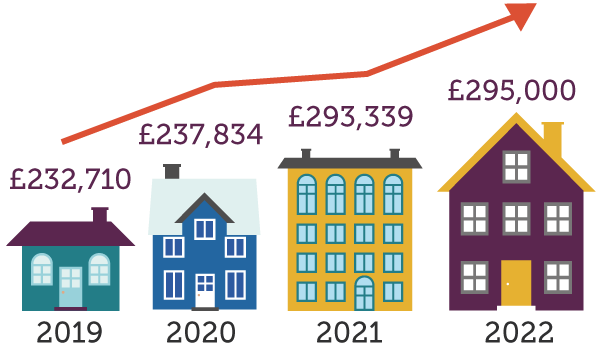

Average house prices in the UK

The average age of a first time buyer is 34. In 2010 it was 31.

Purchasing a first home is one of the greatest costs anyone will come across. For a young adult the thoughts of getting on the property ladder can be daunting, so it is one those milestones that can become more achievable the earlier it is saved for.

The average cost of a first house in the UK was £245,958 in 2022. With an average deposit of 26% this means you would need to save £61,000 for the deposit alone, excluding all house buying fees.

Banks offer 95% mortgages, meaning you could buy a new house with just 5% deposit making getting onto the property ladder today a little bit easier – as long as you already have the savings available.

Looking at the overall average of a first home in the UK has risen by 26% from 2017, meaning the average price is £55,500 higher than it was 5 years ago.

Saving for your big day?

Have you thought about planning yours or your child’s special wedding, one of the happiest days in our lives? Do you imagine big bouquets or a fairy tale wedding with a horse and carriage?

UK weddings scheduled to take place in 2023 cost around £30,000 including honeymoons and pre wedding celebrations. The biggest cost for weddings tends to be the venue, averaging at around £7,600. This isn’t including food and drink which all depends on the number of guests but can add around £3,000 to £4,000. And it doesn’t stop there, as there are further costs for flowers, photographer and entertainment, such as your usual band, DJ to having something a little different at a wedding such as a magician.

Although many weddings have been put on hold in recent times, having an idea of some of the costs involved can help you plan for a happy future with you and your partner, or for your child’s future when they are ready.

Saving to start your family?

The introduction of children into your family is a remarkable experience and changes your life forever. From seeing them take their first steps to sending them off to primary and secondary school, there are costs to give them the best possible life and making them a huge part of your family.

The average cost of raising a child from birth to age 18 could be as high as

£938 a month

So whether having a family is in the near or far future, having a savings pot behind you can help make raising a family a little easier.

Saving for rainy days and sunny vacays?

![]()

Saving for your future is always a great idea, but so is rewarding yourself. Many experts recommend having at least three months’ worth of salary saved and some suggest it should be as much as six months’ worth. Don’t worry, you don’t have to save it up all at once. You can work up to it slowly but surely.

With a rainy day fund in place, you may want to have a separate savings pot for rewarding yourself. Perhaps you fancy going on an extravagant, dream holiday, or want to explore cultures and travel the world.

Want to see different parts of the world? Relax with a book by the pool? With an additional savings pot in your name, these dreams may be possible.

Make the most of your savings

If your child’s Plan is with us you, friends or family can make a contribution to their savings account, so they can be closer towards achieving some of life’s biggest milestones. As the parent or legal guardian, you can manage your child’s Plan online with MyPlans, and family and friends contributing to their Plan can also have their own gifters MyPlans account. So, if you want to make their savings go further, top up to their Plan today.

If you already have a Plan with Foresters, why not top up to your savings by logging into your MyPlans account, which you have access to online 24/7. MyPlans lets you view your Plan value, fund information and make payments into the account in just a few clicks online 24/7. If you haven’t already created your account, activate now

Alternatively, you can request to speak to one of our Financial Advisers through face-to-face or video appointments for discussing your current and future financial needs. Request an appointment

As with all stock market investments the value of the Plan can fall as well as rise, and you may get back less than has been paid in.