Make a contribution to a child's Plan

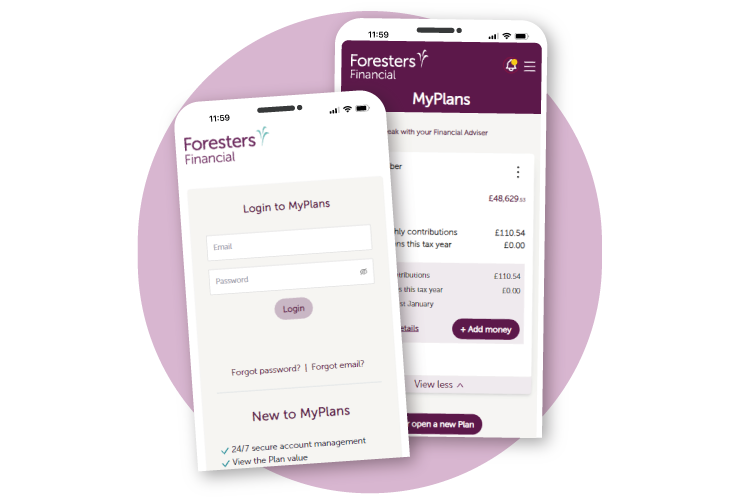

Help give your child the best possible start to adult life by contributing to their future. Anyone can gift to a child’s Child Trust Fund or Junior ISA and we have four easy options for you. Investing carries risk.